Dr Hugh Pemberton

Reader in Contemporary British History, University of Bristol, Department of History

Industrial strategy is back on the government’s agenda, with a promise to produce a ‘match fit’ economy that ‘works for everyone’ and is able to thrive after Brexit. As yet, however, there is little sign of the promised broadly-based and coherent industrial strategy emerging. In crafting it, explains Hugh Pemberton, its architects may profitably look back to the 1960s for some pointers.

For nearly a century, governments have tried to shape Britain’s industrial and commercial landscape. Yet, whilst they often wanted to raise industry’s efficiency and competitiveness, historically there was little consensus on how best to do it. And, whilst ‘industrial policy’ and ‘regional policy’ were often in evidence, the crafting of a broader ‘industrial strategy’ was a rarer event.

Often the focus was on maintaining employment in areas of declining industry. More generally, from the 1940s the government attempted to stimulate company investment using the tax system and (less often) via direct subsidies. Attempts to encourage firms to raise productivity were in evidence. And from 1948, with a new Monopolies and Mergers Commission, there was a desire to promote competition as a route to higher efficiency.

But until the start of the 1960s, there was a notable absence of a coherent overarching strategy.

The 1960s

Things changed in 1961 when Treasury officials, acting on their own initiative, produced for the Chancellor, and subsequently for the Cabinet, the first authoritative attempt by the government to analyse the sources of and barriers to economic growth and set out a strategy to raise productivity, economic growth and living standards.

The Treasury’s ‘Economic Growth and National Efficiency’ report of 1961 was incisive and wide-ranging. It identified a role for government in raising the level and quality of investment, and the quality and mobility of the workforce. It identified scope to improve the quality of management, generate sustainable employment in areas of declining industry, and attack both anti-competitive practices in business and restrictive labour practices.

Beyond this, the Treasury thought government could help to improve the business environment. For example, it recommended putting businesses under pressure by reducing tariffs on international trade. And it proposed that decisions on public spending and taxation be explicitly crafted with a view to creating ‘an efficient full-employment economy capable of sustained growth’.

This forgotten Treasury document was the wellspring of two decades of industrial interventionism. It was given force first by the Macmillan government’s creation of the National Economic Development Council (NEDC), its Office and subordinate industry-level development councils in 1962, and then by the publication of the NEDC’s own analysis (which owed much to that of the Treasury) and programme for faster growth.

Thus was inaugurated the era of ‘indicative planning’ whereby government consulted with employers and unions and set (with clear prime ministerial endorsement) an overall target of 4 per cent annual growth, with subordinate targets for growth and investment in specific economic sectors. Crucially, the government undertook to assume the 4 per cent growth rate in its fiscal policy and investment plans.

Industrial strategy evolved over time. The involvement of the unions was an early example (being judged essential to avoid faster growth feeding wage-push inflation). There was also a growing emphasis on regional policy, which drew on new academic ideas about the promotion of ‘growth poles’ but also on a calculation by Labour after 1964 that it would help sustain support in its electoral heartlands. Policy drifted further away from the Treasury’s initial conception with initiatives such as Labour’s 1965 National Plan and the promotion by a new Industrial Reorganisation Commission of company mergers to attain economies of scale.

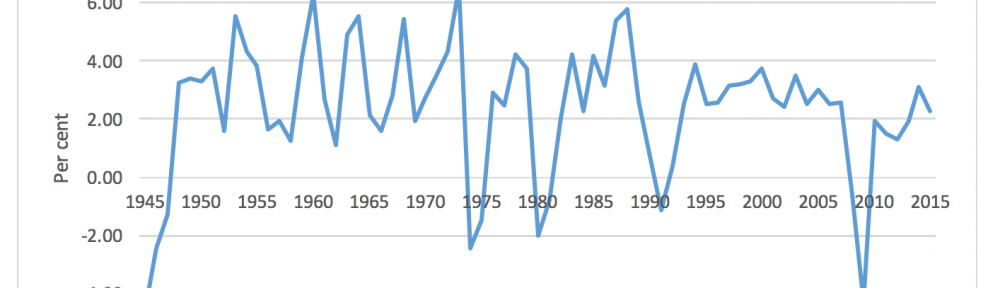

How successful was the wide-ranging industrial strategy of the sixties? As can be seen in Figure 1, the 4 per cent annual growth target set in 1962 was rapidly achieved. But it proved unsustainable as the balance of payments worsened due to unmet domestic demand. That weakened sterling and, in a fixed exchange rate regime, currency stabilisation became the priority from 1966.

The Treasury came to view the whole experience negatively. It had fulfilled its side of the NEDC ‘indicative planning’ bargain by raising investment in physical and human; and it had incentivised and supported private investment through fiscal policy. Yet a sustainable 4 per cent p.a. rate of growth had not been achieved. Later appraisals reached similar conclusions.

Figure 1: Annual change in real UK GDP, 1945-2015

Source: S. Hills, T. Ryland and N. Dimsdale (2016) ‘Three centuries of macroeconomic data, v.2.3′.

Nonetheless, the overall record was better than is often assumed. The average annual growth of GDP was raised – from an average of 3 per cent to 3.6 per cent between 1962 and 1973. Real GDP per capita by the end of that period had risen by 45 per cent (of which about 5 percentage points reflected the higher annual growth rate).

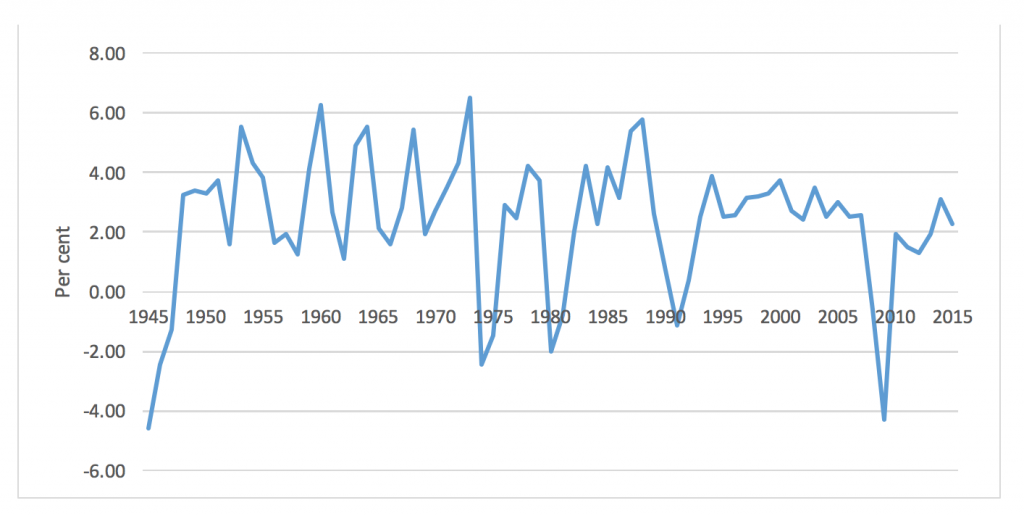

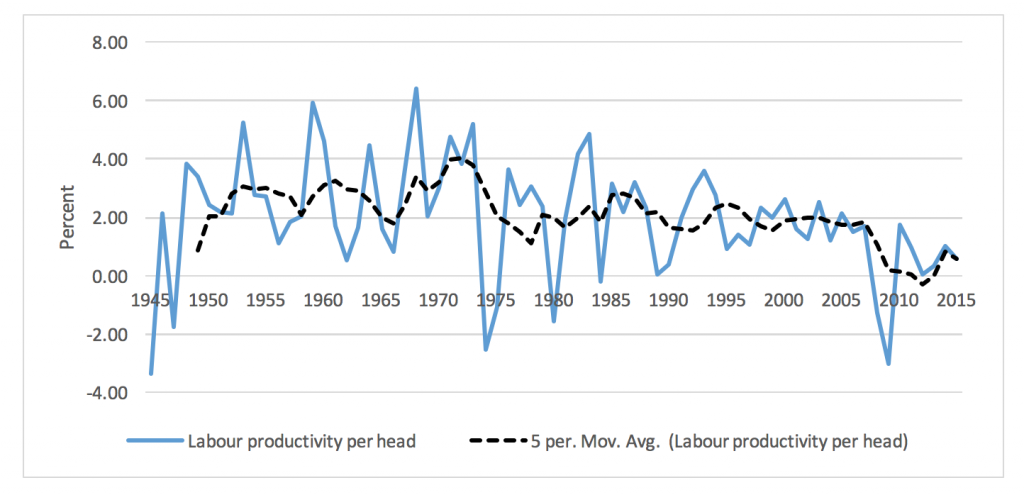

Moreover, the 1960s also saw a notable rise in labour productivity, as is evident in Figure 2. At the start of the decade it was growing by 2.6 per cent a year; by 1967 the annual growth rate was 6.4 per cent – a peak that represented a very significant improvement, but which was then followed by a fairly consistent decline to the present day.

And investments of that decade long out-lasted the industrial strategy itself (e.g. the motorway system, an entirely new national gas supply network, nuclear power stations, modernised state-owned industries such as coal, steel and the railways, and the significant expansion and improvements in schools, technical colleges and universities).

Figure 2 Annual growth rate of labour productivity per head, 1945-2015

Source: S. Hills, et al (2016) ‘Three centuries of macroeconomic data, v.2.3′.

Two lessons for today’s policy-makers

The first lesson from the past is that industrial policy achieves more when it is part of a broad strategy for growth. There is not much point in saving individual car plants from the consequences of Brexit if they are unable to recruit staff with the necessary skills, if they struggle to move their inputs easily and cost effectively, or if they face an unhelpful tax regime, crippling tariffs, and export bureaucracy.

Yet, so far, the post-Brexit actions of the government are more reminiscent of the more narrowly focused and ad-hoc industrial policy of the 1970s, with its emphasis on job preservation, than they are of the coherent overarching industrial strategy of the 1960s. As Craig Berry has pointed out, there is little evidence yet of coherent thinking or of institutions working together within an overarching programme for the retooling of a more productive economy.

It is far from clear that the Treasury is signed up to such a strategy (despite the recent recognition by the OECD’s chief economist that ‘fiscal initiatives could catalyse private economic activity’ and enable us to ‘exit the low-growth trap’). We remain trapped in the ‘austerity’ mindset of 2010-15, unable to see the virtues of public borrowing for investment.

The second lesson is that, although the industrial strategy of the 1960s became discredited we need to recognise that much growth in later decades was built upon it. For example, we’re still driving on its motorways, we power and heat homes, offices, and factories using utility networks that have at their heart the infrastructure of that era, and many of us benefitted from its investments in education and training.

The 1960s shows that well-targeted government infrastructure spending purchases productive assets with long-term growth potential; we would realise this if only we could reconceptualise national accounting to embrace a national balance sheet as well as an annual government profit and loss account.

____

This post was first published in the LSE British Politics and Policy blog.

Note: A longer version of this article is available in the current issue of Juncture, the IPPR’s journal of politics and ideas. For further reading see O’Hara G (2007) From Dreams to Disillusionment: Economic and Social Planning in 1960s Britain (Palgrave Macmillan); Pemberton H (2004) Policy Learning and British Governance in the 1960s (Palgrave Macmillan).